Is 2025 the Year Crypto On-Ramps Became Real Financial Infrastructure?

The first half of 2025 has revealed a seismic shift in the crypto ecosystem. Once considered speculative access points, crypto on-ramps are now emerging as core components of global financial infrastructure. In Paybis’ latest H1 2025 report, the company highlights how deep-rooted regulatory clarity, a move toward real-time bank rails, and surging institutional flows are redefining the on-ramp landscape.

From the phased implementation of the EU’s Markets in Crypto-Assets (MiCA) regime to the U.S. GENIUS Act offering federal clarity on stablecoins, these changes aren’t just boosting volumes they’re laying the groundwork for how digital assets are used in cross-border payments, treasury functions, and enterprise settlements.

Investor Takeaway

Іnstitutional flows now make up 82% of Paybis’ settled volume. This is no longer a retail-dominated story crypto rails are becoming vital for corporate finance and compliance-led adoption.

What Macro and Regulatory Drivers Are Shaping This Evolution?

Two macro forces are transforming crypto on-ramping into a critical financial backbone:

Regulatory Convergence via MiCA and GENIUS Act: MiCA’s phased rollout in Europe (EMT/ART rules effective from June 30, 2024; CASP licensing effective December 30, 2024) has become a global benchmark. The U.S. followed suit with the GENIUS Act (July 2025), establishing full-reserve requirements and monthly attestations for stablecoin issuers.

Real-Time Banking Rails Replacing Cards: Instant account-based systems are now outpacing cards in major economies. Brazil’s Pix handled over R$26 trillion in 2024, India’s UPI processed ₹25 lakh crore in July 2025 alone, and the U.S. RTP network hit $481 billion in Q2 2025. The EU now mandates pricing parity between instant and traditional credit transfers, incentivizing larger transactions.

Investor Takeaway

Real-time payment systems like Pix and UPI are pushing on-ramp providers toward account-based rails. This shift is compressing card-driven margins and favoring FX-spread-driven models.

How Are Institutional and Retail Behaviors Changing?

Retail Patterns: More Self-Custody, Higher Transaction Sizes

Median transaction value climbed to $604, tracking Bitcoin’s rise from $61K to $93K.

74% of first-time Paybis users opted for self-custody wallets like Ledger Live and Rabby over exchange deposits.

Institutional Adoption: Embedded, Automated, Scalable

Corporate onboarding times dropped by 37%.

Stablecoin swaps are increasingly embedded in Treasury Management Systems (TMS) via APIs.

White-label integrations captured 19% of total market volume, up from 7% YoY.

Investor Takeaway

Retail is going wallet-first, while institutions are embedding crypto into core treasury workflows. On-ramp providers must optimize both fronts: UX for wallets, APIs for corporates.

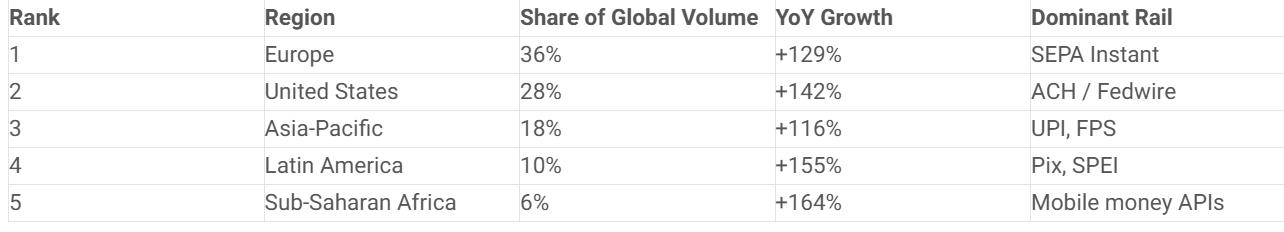

Which Regions and Rails Are Driving Growth?

Regional volumes are heavily shaped by local payment infrastructure and inflationary dynamics:

This growth correlates with the expansion of high-speed settlement networks and inflation-driven stablecoin demand, especially in Latin America and SSA.

Investor Takeaway

Stablecoins are displacing fiat in high-inflation markets. Look for growth in regions with both regulatory clarity and real-time payment adoption.

How Does Paybis Compare in the Competitive Landscape?

Paybis is outperforming competitors in institutional penetration:

Pricing pressure is fiercest in small-ticket retail, where headline rates dropped ~22% YoY. In contrast, large corporate deals remain relationship-driven, with minimal fee erosion.

Investor Takeaway

Institutional flows remain sticky and margin-resilient. Firms like Paybis that bundle services and optimize treasury flows are best positioned to preserve spreads.

What Does Paybis’ Growth Reveal About Market Structure?

User Growth: +90% YoY in unique verified users.

Volume Growth: +179% YoY in total settled volume.

B2B Dominance: 82% of volume came from business clients.

This growth wasn’t margin-dilutive Paybis’ shift toward OTC and enterprise flows offset tightening spreads. Key enablers included service bundling, custom settlement windows, and multi-rail support via vIBANs.

Investor Takeaway

Paybis’ success is built on infrastructure, not hype. Multi-rail banking and low-friction onboarding now matter more than brand or ad spend.

What’s the Outlook for H2 2025 and Beyond?

Regulatory Divergence, Not Convergence: Global talks on harmonization (IMF, BIS, FSB) remain non-binding. National rules on reserves, attestations, and issuer structures will likely remain fragmented.

Bank-Issued Stablecoins Rise: Projects like JPMorgan’s Kinexys and the Regulated Liability Network are gaining steam, but remain private and restricted.

Layer-2 Activity Grows, But L1 Still Dominates for Enterprises: While Base, Arbitrum, and OP are growing transaction count, most stablecoin settlement value remains on L1 and off-chain bank rails due to liquidity and compliance.

Green On-Ramps Remain Aspirational: ESG and carbon accounting frameworks are fragmented, delaying institutional commitments to “green crypto.”

Investor Takeaway

Prepare for regulatory fragmentation, not a global standard. Institutions need to comply locally while innovating globally multi-jurisdictional agility is key.

Conclusion: From Front-Ends to Infrastructure

The message from Paybis’ H1 2025 report is clear: crypto on-ramps are evolving into regulated FX gateways, powered by stablecoins, real-time banking rails, and API-first design. Retail demand is real, but it’s enterprise flows and compliance-ready infrastructure that are setting the pace.

As the industry enters H2 2025, winners won’t be defined by who has the best marketing or widest reach. They’ll be the providers who’ve already laid the groundwork for a regulated, instant, and institutional-grade crypto economy.

Investor Takeaway

Crypto’s next cycle won’t just reward token pickers it will reward infra builders. Focus on firms with deep banking rails, regulatory foresight, and B2B traction.

Company name: Paybis

Contact name: Innokenty Isers

E-mail: support@paybis.com

Website: https://paybis.com

Country: USA